Save time and money

With a unified experience that streamlines their onboarding.

Verify with precision

Improve origination with our comprehensive customer verification APIs.

Make quicker decisions

Consolidate insights from multiple data sources.

Reduce cost of risk

Get flags and alerts on suspicious user behaviour.

Multiple services in one

We offer a suite of API products designed to empower your business.

-

Verification

Run automated KYC/ KYB processes with the following verifications: business registration, Identity number, bank account, phone number and many more.

Learn more -

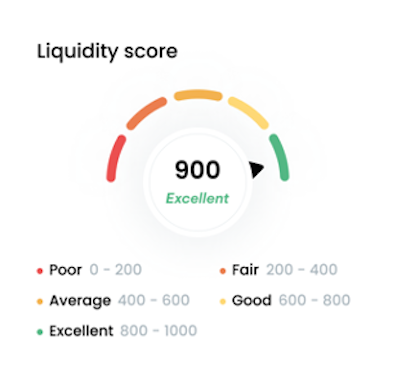

Risk Analyis

Aggregate bank transaction history feed or analyse bank statements and get affordability, liquidity and risk assessments. Enhance decisions with financial analysis and health forecasts.

Learn more -

Fraud Intelligence

Perform AML/PEP checks on customers, along with sanction listings and default listings. Flag suspicious behaviour, tempered documents and information mismatches.

Learn more

Businesses spend a lot of time and money originating customers

Problems you don't have to worry about with Akiba.

Fragmented data wastes your time

Our clients struggle to have a

single real-time view of customers' performance data from cashflow, to

compliance to ID verification etc.

As a data aggregator, Akiba Digital aims to create a single digital profile

of your customer, empowering your decision-making capabilities.

High drop off rates cost you money

Lengthy assessment processes

introduces friction in the user experience which results in high application

churn. As a result, you stand to lose customers at onboarding.

Our origination widget intelligently collects user data with minimal

bottlenecks and friction points.

Don't just take our word for it

What Our Customers Are Saying.

We are building a better application process now, thanks to Akiba Digital.

Our application is undergoing significant improvements with the help of Akiba Digital, resulting in enhanced functionality, improved user experience, and advanced features for a better and more satisfying user journey.

Trade Capital

Great Service from a expert support system of Akiba.

Experience exceptional service and support from Akiba's expert team, dedicated to providing knowledgeable assistance and ensuring a seamless and satisfying user experience.

Kai Connect

Pricing is amazing for the small businesses around the world.

The Akiba pricing is tailored to suit the needs of small businesses worldwide, offering affordable and competitive rates that provide excellent value for money without compromising on quality or service.

Afrika Finance

Start saving money & time now